Excel and economics are made for each other. The material on this page represents the teaching materials for ECON2050 Economic Analytics Using Computer Methods. The text includes links to videos that explain techniques and procedures in more detail. The material here excludes practice problems and answers and tests with answers, all of which are essential for completing this course.

This course starts simply … we cover how to compute 2 + 2 = 4. By the end of Module 13, students learn how to use Excel to solve the differential equations underlying “flattening the curve” in the standard infectious disease model.

Several caveats exist for this course:

- The course presumes no knowledge in Excel, but the reader will be served well by remembering basic math and first year micro and macroeconomics.

- Excel often has more than one way to solve a problem and the course starts with basic approaches that will strike the experienced Excel user as simplistic. As the course proceeds, more advanced methods come into play.

- The course materials rely on Microsoft 365, but many videos still refer to Office 2019; the functionality is essentially the same for problems addressed. I will update these videos in due course.

- This is not a course in Excel. It is a course in economic analytics that uses Excel to explain economic and business processes. Therefore, it focuses on the financial and statistical formulas and does not really treat the data management tools available in Excel.

Click on each title to retrieve the PDF. Within the text, links to videos serve to explain concepts in more depth. The text also refers to examples and exercises, but only students registered in this course at the University of Manitoba have access to these materials.

Acknowledgements

Many capable research and teaching assistants have contributed to this text. I would like to thank Huibert Scarlett, Matthew Stargardter, Elisabet Rodriguez-Llorian, Francis Dzipke, and Thuhid Noor all of whom offered many valuable suggestions and corrections. Of course all imperfections remain my responsibility

This is an orientation to Excel for the uninitiated and those who require a refresher

Module 2 – Understanding data and creating graphs

This Module explains the concept of economic analytics, reviews the structure of economic data, presents the techniques for creating professional graphs and tables, describes how to export graphs and tables to Word, and presents added functions.

After you have defined the problem and acquired/processed the relevant data, the next step in any economic analytics exercise involves data descriptions to begin understanding the relationships among the variables. This Module begins the Level 2 analysis described at the start of Module 2.

Module 4 – Measuring, comparing, and modelling

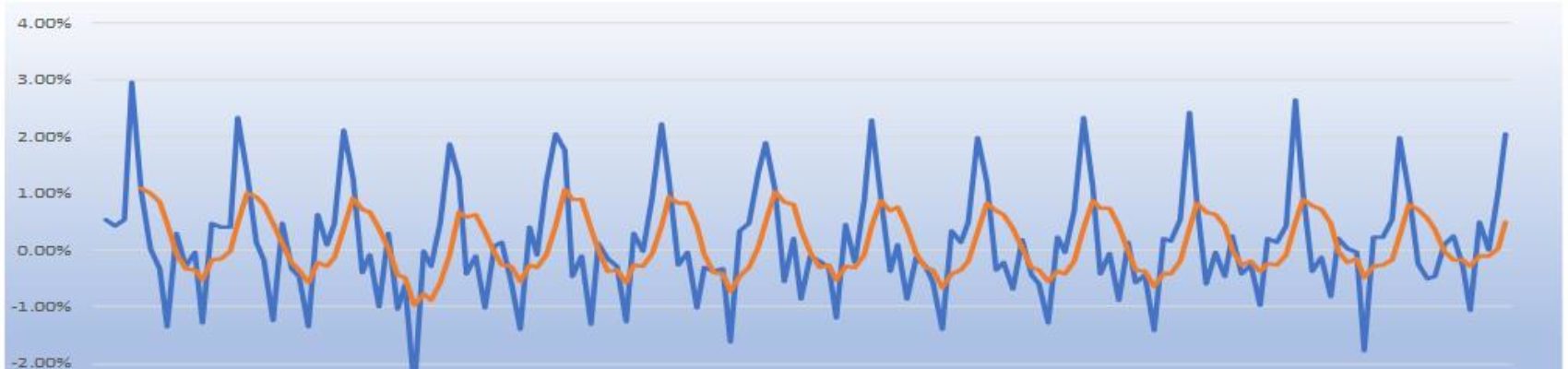

This Module introduces methods for measuring change in time series data, the concept of an index number, and the simple demand and supply.

Probability theory underlies statistics, econometrics, and simulation modelling. This Module introduces basic ideas of statistics, presents several probability distributions that find wide use in analytics, and develops the Excel needed to with probability problems.

This Module (and the next) presents regression, a core tool in data analytics and economic analysis. It explains relationships among economic variables and serves as a foundation for prediction and forecasting.

Module 7 introduces more sophisticated specification of dummy variables, assessing the quality of the regression of the regression coefficients, and using regression as a forecasting model.

Module 8 – Time value of money and economic decisions

“Time is money,” or so the saying goes. In this Module, we invert this to say ”money is time.” Our valuation of money depends on when we receive it. Because life is uncertain, we usually prefer income now, unless we receive additional payment in the form of interest. The time value of money forms the foundation for most economic decisions.

Module 9 – Taxation and inequality

Taxation and measures to mitigate inequality/poverty represent an area of expanded government scope. This module will reveal how taxes operate, especially personal income taxes, and how changes to the tax rates affect income inequality.

Much of economics focuses on maximizing or minimizing some quantity (revenue, costs, profits, etc.), or finding an equilibrium point. Excel supports a range of optimization problems common to economic and business analytics. This Module will equip you with a basic understanding of these techniques, which lay the foundation for linear programming, a common starting point for the study of operations research. We start with the simple economics of demand, then add supply, and then look at solving basic optimization problems.

Module 11 – Linear programming

Module 11 presents the linear programming model, which serves as the foundation for operations research. It also presents the basic linear optimization model in microeconomics. This module will help you refine your ability to set up and solve elementary linear optimizations.

Module 12 – Matrices and array formulas: applications to economics

Important models in economics feature matrices. Array formulas are a common method in Excel for calculating matrix operations, some of which are so common they are now functions – the =SUMPRODUCT being a common example. Microsoft 365 has added improved functionality in the form of dynamic arrays that reduce the work in setting up and using array formulas.

This Module examines models in economics that use matrices, such as the input-output model, which expresses linear regression in matrix format. In passing, this Module presents additional Excel procedures that will speed up your work.

Module 13 – Simulation and Monte Carlo Analysis

Many specialized software systems and platforms support simulation. Excel can serve as a preliminary method for exploring changes in a simulation model

After reviewing the concepts of projection and forecasting based on the regression model, this Module explores how to generate scenario values using the four probability distributions as an extension of the material in Module 7. Monte Carlo models and the use of data tables for common business and economic problems complete the discussion.