Fallacies in gas price sensitivity

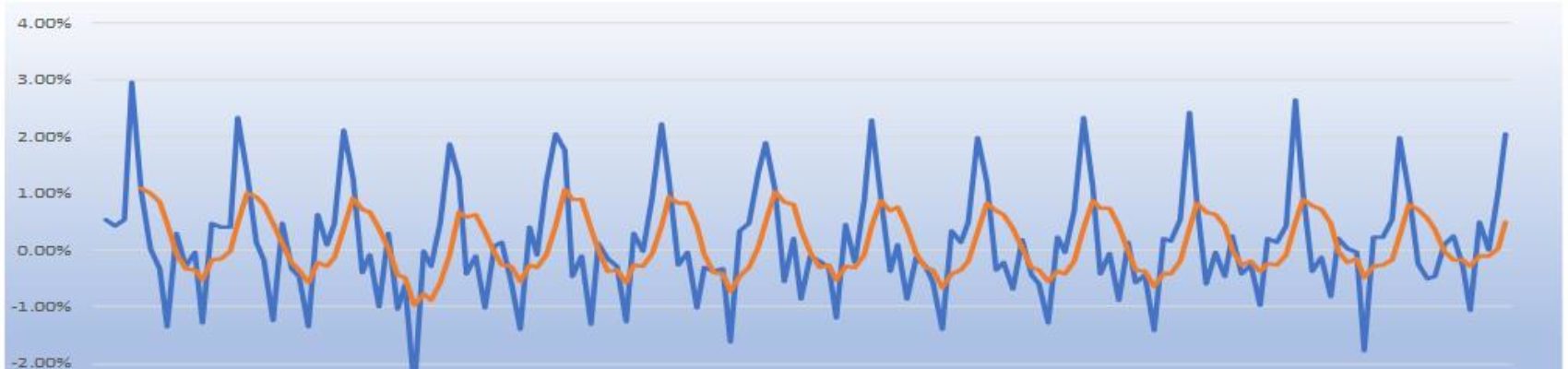

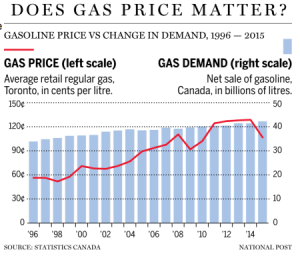

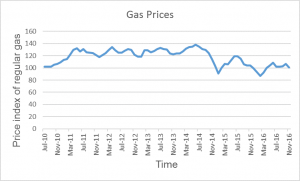

Dec 27, 2017 Writing in the Financial Post, Terence Corcoran argues (read original article here) that gas prices have had no impact on the demand for gasoline. He presents the proof positive as the following chart  This is a classic example of simultaneous equations bias, which typically occurs when one uses time series data to test a theory that pertains to static equilibrium. The key to the fallacy is that the relationship between the price of a product and the quantity demanded of that product is the ceteris paribus assumption that “everything else being equal”; when prices increase, quantity demanded falls. This is a completely unrealistic assumption as every first year student in economics is fully aware (at least those that pass with a C). But it is a very useful device in thinking through the relattionships in demand and supply

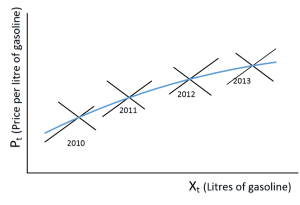

This is a classic example of simultaneous equations bias, which typically occurs when one uses time series data to test a theory that pertains to static equilibrium. The key to the fallacy is that the relationship between the price of a product and the quantity demanded of that product is the ceteris paribus assumption that “everything else being equal”; when prices increase, quantity demanded falls. This is a completely unrealistic assumption as every first year student in economics is fully aware (at least those that pass with a C). But it is a very useful device in thinking through the relattionships in demand and supply  Everything does change; this is the only constant in the economy. A truer picture of what is going on in the above chart is that it shows a series of market equilibrium points. The chart at the left shows that the overall trend in gas prices from 2010 to 2013 has been upward, yet total quantity sold (and therefore demanded) has also increased due to economic and demographic growth. The problem is what is known as simultaneous equation bias

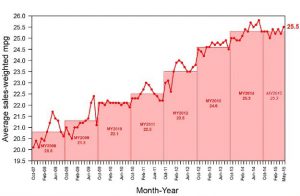

Everything does change; this is the only constant in the economy. A truer picture of what is going on in the above chart is that it shows a series of market equilibrium points. The chart at the left shows that the overall trend in gas prices from 2010 to 2013 has been upward, yet total quantity sold (and therefore demanded) has also increased due to economic and demographic growth. The problem is what is known as simultaneous equation bias  An offsetting “other factor” is the increase in fuel efficiency of cars (Source). The typical pickup is still much less efficient than a hybrid car, the penalty paid for driving one has declined. Average fuel efficiency continues rise as seen below. This rise in efficiency has reduced the penalty of driving larger vehicles. What is disingenuous about Mr. Corcoran’s graph is that it understates the recent decline in gas prices (Source) that started when the Arab oil states (read Saudi Arabia) decided to try and under-cut America’s new found fossil fuel self-sufficiency by increasing reducing supply and price.

An offsetting “other factor” is the increase in fuel efficiency of cars (Source). The typical pickup is still much less efficient than a hybrid car, the penalty paid for driving one has declined. Average fuel efficiency continues rise as seen below. This rise in efficiency has reduced the penalty of driving larger vehicles. What is disingenuous about Mr. Corcoran’s graph is that it understates the recent decline in gas prices (Source) that started when the Arab oil states (read Saudi Arabia) decided to try and under-cut America’s new found fossil fuel self-sufficiency by increasing reducing supply and price.  The main idea behind the article may be correct – a carbon tax may not reduce the amount of fossil fuel consumed, but the combination of consumers electing to purchase more efficient cars, due in part to the cost of fuel, coupled with emissions regulations, and a sluggish economy are examples of the everything else not being equal. How these interacting forces play out is what makes carbon reduction policies so tricky.

The main idea behind the article may be correct – a carbon tax may not reduce the amount of fossil fuel consumed, but the combination of consumers electing to purchase more efficient cars, due in part to the cost of fuel, coupled with emissions regulations, and a sluggish economy are examples of the everything else not being equal. How these interacting forces play out is what makes carbon reduction policies so tricky.